The 7-Second Trick For Prf Insurance

Prf Insurance Fundamentals Explained

Table of ContentsPrf Insurance Things To Know Before You BuyThe Prf Insurance PDFsNot known Details About Prf Insurance What Does Prf Insurance Mean?The Greatest Guide To Prf Insurance

Farm as well as ranch residential property insurance coverage covers the assets of your ranch and cattle ranch, such as livestock, tools, structures, installations, and also others. These are the typical protections you can obtain from farm as well as cattle ranch residential or commercial property insurance.Your farm and also cattle ranch makes use of flatbed trailers, enclosed trailers, or energy trailers to transport products and devices. Business automobile insurance coverage will certainly cover the trailer yet just if it's connected to the insured tractor or vehicle. If something takes place to the trailer while it's not attached, after that you're left on your own.

Workers' settlement insurance offers the funds a worker can use to buy drugs for a work-related injury or disease, as prescribed by the physician. Workers' compensation insurance covers rehab. It will certainly additionally cover re-training expenses to ensure that your staff member can resume his work. While your employee is under rehabilitation or being trained, the policy will provide an allocation equal to a percentage of the average weekly wage.

You can guarantee on your own with workers' compensation insurance coverage. While purchasing the plan, service providers will offer you the liberty to consist of or exclude yourself as a guaranteed.

The Best Strategy To Use For Prf Insurance

To get a quote, you can deal with an American Household Insurance agent, chat with representatives online, or phone American Household 24 hours a day, 365 days a year. You can sue online, over the phone, or straight with your agent. American Family has actually been in business considering that 1927 and also is relied on as a provider of insurance policy for farmers.

As well as, there are a few various kinds of ranch vehicle insurance policies readily available. The insurance policy requires for every kind of vehicle vary. By spending just a little time, farmers can increase their understanding concerning the various kinds of ranch vehicles as well as choose the most effective and also most cost-effective insurance coverage services for each.

Whatever service provider is composing the farmer's auto insurance coverage, hefty as well as extra-heavy trucks will certainly require to be placed on a industrial vehicle policy. Trucks entitled to a business ranch entity, such as an LLC or INC, will require to be positioned on an industrial policy despite the insurance policy service provider.

What Does Prf Insurance Do?

If a farmer has a semi that is made use of you could look here for hauling their very own ranch products, they might have the ability to include this on the exact same commercial vehicle this page policy that guarantees their commercially-owned pickup trucks. If the semi is made use of in the off-season to transport the items of others, a lot of typical farm and business vehicle insurance coverage providers will certainly not have an "hunger" for this kind of risk.

A trucking plan is still a business auto plan. The providers that provide protection for procedures with cars made use of to carry goods for 3rd events are generally specialized in this kind of insurance. These types of operations develop greater risks for insurance firms, larger claim quantities, and a higher severity of insurance claims.

A knowledgeable independent representative can assist you understand the kind of plan with which your industrial automobile must be insured and also discuss the nuanced ramifications and insurance coverage effects of having several car plans with various insurance carriers. Some vehicles that are used on the farm are insured on individual automobile policies.

Business automobiles that are not eligible for a personal auto policy, but are used exclusively in the farming procedures provide a reduced danger to insurance companies than their business use counterparts. Some their website carriers decide to guarantee them on a ranch automobile policy, which will certainly have somewhat different underwriting standards and also ranking frameworks than a routine commercial vehicle plan.

How Prf Insurance can Save You Time, Stress, and Money.

Kind A, B, C, as well as D.

Time of day of use, miles from the home farm, ranch other as well as various other to use types of vehicles. As you can see, there are numerous kinds of ranch vehicle insurance policy policies offered to farmers.

Getting My Prf Insurance To Work

Please note: Details and also insurance claims offered in this content are suggested for interesting, illustratory objectives and also must not be taken into consideration legally binding.

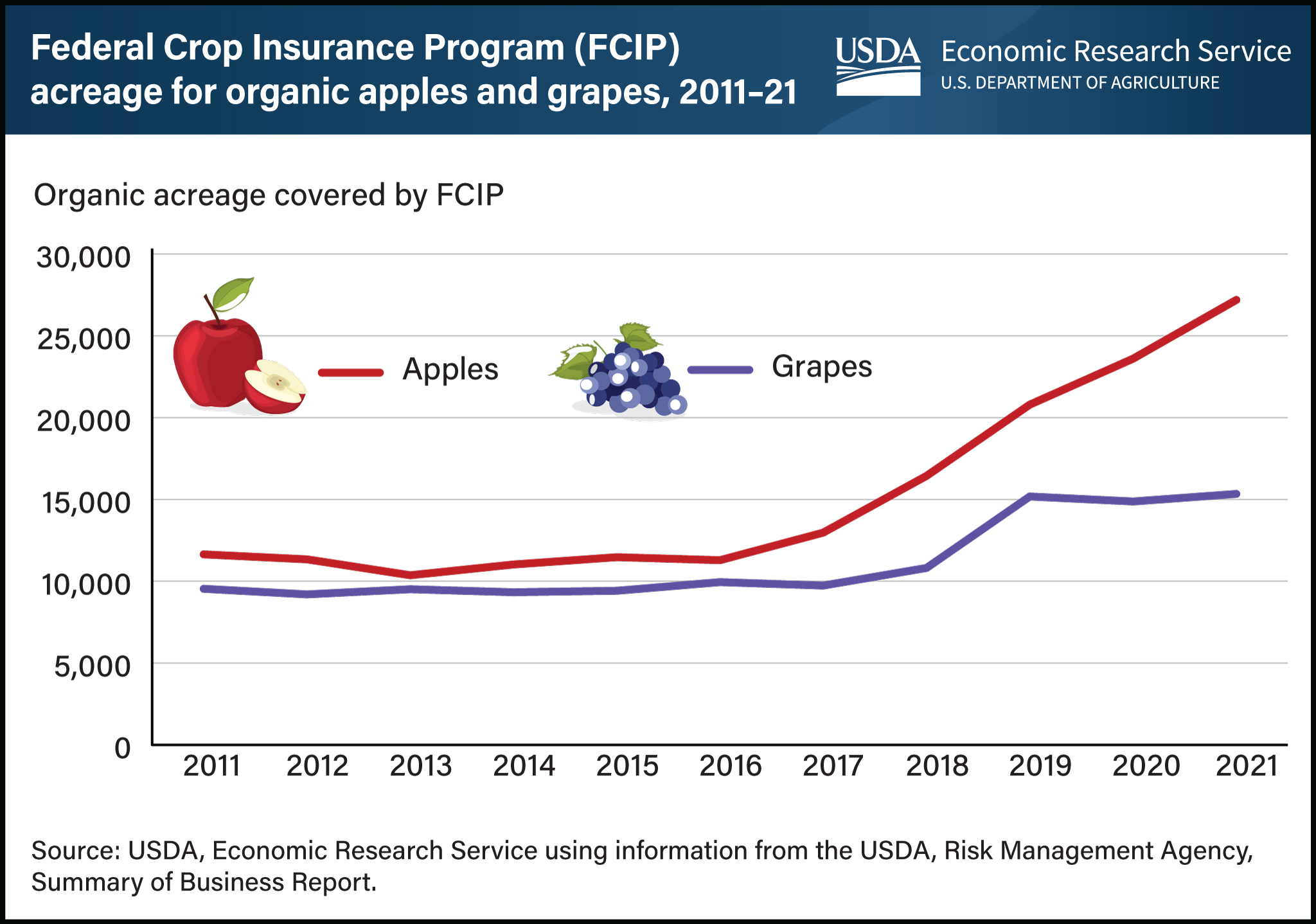

Plant hailstorm coverage is marketed by private insurers as well as regulated by the state insurance policy divisions. It is not component of a federal government program. There is a government program supplying a variety of multi-peril crop insurance products. The Federal Crop Insurance policy program was developed in 1938. Today the RMA provides the program, which offered plans for greater than 255 million acres of land in 2010.

Unlike other sorts of insurance, crop insurance coverage hinges on recognized dates that relate to all plans. These days are determined by the RMA ahead of the planting period and also released on its site. Dates vary by crop as well as by region. These are the important days farmers should anticipate to satisfy: All plant insurance policy applications for the designated region as well as plant schedule by this day.